Bankruptcy is a legal process that can provide relief to individuals and businesses overwhelmed by debt. While it can be a daunting prospect, understanding the options available and the implications of filing for bankruptcy is crucial for anyone facing financial difficulties. This article offers essential advice for navigating bankruptcy, including the different types of bankruptcy, the process involved, and alternatives to consider.

Understanding Bankruptcy

Bankruptcy is designed to help individuals or businesses eliminate or repay their debts under the protection of the bankruptcy court. In the UK, there are two primary types of bankruptcy for individuals:

- Bankruptcy: This is typically suited for individuals unable to pay their debts. When you file for bankruptcy, your assets may be sold to repay creditors, and any remaining debts may be discharged, giving you a fresh start.

- Individual Voluntary Arrangement (IVA): An IVA is an alternative to bankruptcy where you agree to repay a portion of your debts over a set period, typically five to six years. At the end of this period, any remaining unpaid debts are written off. An IVA allows you to retain your assets, making it a preferable option for many.

The Bankruptcy Process

Filing for bankruptcy involves several steps, and understanding this process can help alleviate anxiety:

- Seeking Professional Advice: Before deciding to file for bankruptcy, it’s essential to consult with a financial advisor or an insolvency practitioner. They can help assess your financial situation and discuss all available options, including bankruptcy, IVAs, or other debt solutions.

- Filing for Bankruptcy: If bankruptcy is deemed the best option, you will need to complete a bankruptcy application. This can be done online through the official government website. The application requires detailed information about your finances, including debts, assets, income, and expenditures.

- Receiving a Bankruptcy Order: If your application is approved, a bankruptcy order will be issued. This order officially declares you bankrupt and sets in motion the process of managing your debts.

- Appointment of a Trustee: Upon declaring bankruptcy, a trustee will be appointed to oversee your case. The trustee’s role includes assessing your financial situation, managing your assets, and ensuring creditors are paid as much as possible from the sale of any non-exempt assets.

- Asset Management: The trustee will evaluate your assets to determine which can be sold to repay creditors. Certain assets may be exempt, such as basic household items and tools for work.

- Debt Discharge: Generally, debts are discharged after one year of bankruptcy, provided you have complied with the terms set by the trustee. This means you are no longer legally obligated to pay the discharged debts.

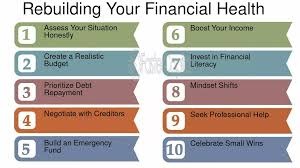

Alternatives to Bankruptcy

While bankruptcy can provide a fresh start, it is not always the best solution for everyone. Consider these alternatives:

- Debt Management Plans (DMPs): A DMP allows you to pay back your debts at a rate you can afford. This is an informal agreement with creditors to reduce payments and freeze interest.

- IVAs: As mentioned earlier, an IVA allows you to repay a portion of your debts over a specified period while keeping your assets.

- Credit Counseling: Seeking advice from a credit counseling service can help you explore your options, negotiate with creditors, and develop a plan for managing your debts without resorting to bankruptcy.

- Negotiating with Creditors: Sometimes, creditors may be willing to negotiate a repayment plan or settlement. Open communication can lead to more manageable payment terms.

Impact of Bankruptcy

Filing for bankruptcy has significant implications, including:

- Credit Rating: Bankruptcy can severely impact your credit rating, making it difficult to obtain credit in the future. The bankruptcy will remain on your credit report for six years from the date of filing.

- Public Record: Bankruptcy is a matter of public record, which means it can be accessed by anyone conducting a background check.

- Employment Considerations: Some professions may require financial checks, and a bankruptcy filing could affect your employability in those fields.

Conclusion

Bankruptcy can be a complex and emotional journey, but it is important to remember that it is designed to provide a pathway out of overwhelming debt. By seeking professional advice, understanding the process, and exploring all available options, individuals can navigate this challenging time more effectively. Whether bankruptcy or an alternative solution is chosen, taking proactive steps can lead to a brighter financial future.

Check out Irwin Insolvency for more.